State Bank of India Kisan Credit Card- Kisan credit card (KCC) is specially designed for the farmers of the country to provide them with financial support. The aim of this scheme is to meet the financial need of the farmers by offering them term loans.

National Bank for Agriculture and Rural Development developed this model. Participatory member banks that provide a card to farmers include various commercial banks, regional rural banks, and state co-operative banks. Kisan credit card helps farmers to get loan at the time of need without any problem.

The card is issued based on certain factors, such as the repayment of previous loans on time and the land assets one holds in his name. The basic aim behind the KCC is to ensure that farmers in the country have enough credit in one single window.

Table of Contents

What is the State Bank of India Kisan Credit Card Scheme?

Following the directions of the Government SBI provide State Bank of India Kisan credit card (KCC) to the farmer of the country at low-interest rates with flexible tenure. The card given to the farmers by the bank is to make sure that they can get the required credit on time for crop production, associated agriculture activities, emergency expenses, etc.

With easy documentation and a simple sanction, process credit is given to farmers.

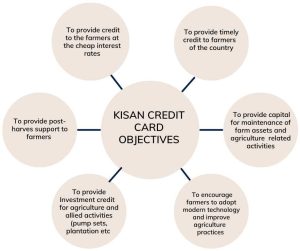

Objectives of Kisan Credit Card

The government of India started the KCC scheme with the following objectives:

Kisan Credit Card (KCC) Benefits and Features

State bank of India Kisan credit card provides several features and benefits to the cardholders which are:

- KCC holders can earn interest on the amount which they maintain in their Kisan credit card account.

- Farmers having KCC will receive a 2.00% interest subsidy per year on loans up to Rs. 3.00 lakh. On fast repayments up to 3.00% additional interest subsidy per year.

- All SBI Kisan credit cardholders who are sowing certain crops in certain areas are provided with crop insurance.

- The amount of credit to be given to the farmer will be determined on the basis of cultivation costs, post-harvest costs, and other maintenance costs.

- Loan amount after the first year is determined on the basis of economic growth

- No security is required up to the loans of Rs. 1.60 lakh

- Currently, State Bank charge a simple interest rate of 7.00% per year for Kisan credit or repayment due date, whichever is earlier

- The interest rate on the KCC will be applied if no repayment within the due date is made. Interest will increase every 6 months after the due date.

- The repayment period of the credited amount will be determined on the basis of the harvest and marketing period of the planted crop.

Application for Kisan Credit Card – How Can I Get Kisan Credit Card

-

- A farmer can apply for a Kisan credit card by visiting the nearest branch of the State Bank of India.

- Contact the concerned officer at the bank and ask for a credit card (KCC) application form.

- Fill in the application and submit it along with the documents required to process your case

- After applying the bank will check it and if the details found correct the bank will issue an SBI Kisan credit card

- One can also download the KCC application form online from the website of SBI at https://sbi.co.in

Also Read: SBI Personal Online Netbanking – Online SBI Netbanking

Documents for KCC Loan (KCC Documents Requirement)

The farmers who wish to get a Kisan credit card have to furnish the following documents to get the KCC.

- Application form correctly filled in all respects

- Voter ID card/PAN card/Passport/Aadhaar card/Driving license for identity proof

- Electricity bill/lease agreement/Aadhaar card for address proof

Who Can Apply For Kisan Credit Card – Eligibility For KCC

Below types of farmers are eligible to apply for Kisan Credit Card (KCC).

- Any farmer whether they are individuals, joint cultivator owners, Tenant farmers, oral lessees, and sharecroppers, etc. can apply for this credit card

- Self Help Groups and Joint liability groups including tenant farmers can also apply for SBI Kisan credit card

KCC Annual Renewal

Every farmer who owns a Kisan credit card has to renew his KCC account every year on the due date to receive the assigned credit limits. This renewal must be carried out throughout the five years. The cardholder must submit a revival letter or statement to the State Bank of India before the expiration date.

Following the renewal, a revision of the maximum withdrawal limit will be considered in accordance with the envisaged crop model and the area approved by the borrower.

Repayment for KCC Credit

- For a single Kharif crop loan repayment has to be made within 31st January

- For a single Rabi crop, loan repayment has to be made within 31st July

- Loan repayment for multiple Kharif/Rabi/double-crop has to be made within 31st July

- For long term crop loan repayment can be made around the year from the date of disbursement

Borrowers who repay must ensure that the amount is transferred to their KCC (Kisan credit card) account. The amount to be repaid must be the minimum amount of the loan, including applicable interest and other charges, before the due date.

Security For SBI KCC

State Bank of India Kisan Credit Card is convenient way for the farmers to get a quick load. Up to the credit amount of Rs. 1.60 lacks the bank may not require a security/guarantee. But if the loan amount is more than 1.60 lacks then the bank seeks a guarantee/security.

The options below are usually sought out by bank but, the SBI reserves the last word on what it considers appropriate:

- Crop sown by the use of loan amount as hypothecation

- Machinery that is purchased by the loan amount as hypothecation

KCC– Things to Remember

- The interest rate may be lowered for a borrower if he made payment before the due date

- If customers do not pay before the due date, they will be liable for accrued interest and may have to pay late payment charges.

- Kisan credit cardholders can earn interest on the amount they maintain in their KCC account

- For different areas as well as the crops grown by the farmers the terms and conditions may vary

Conclusion

KCC Kisan Credit Card is a credit distribution mechanism the aim of the credit facility is to provide quick, timely access and affordable loans to farmers of the country. It was initiated by the Central Bank of India and NABARD in 1998. The goal of the program is to reduce farmers’ reliance on the informal banking sector for loans – which can be very costly and drag farmers into a debt spiral.

SBI provide State Bank of India Kisan Credit Card to the farmers to facilitate them to get quick and timely credit for the production of crops. The other banks that provide KCC include public sector banks, regional banks, and co-operative banks.