The Prime Minister’s Employment Generation Programme PMEGP loan scheme for startups was launched in 2015. The scheme is a vital initiative by the Government of India aimed at fostering entrepreneurship and job creation.

The Ministry of Micro, Small and Medium Enterprises (MoMSME) is administrating the PMEGP scheme. Launched with the objective of encouraging micro-enterprises in both urban and rural areas, the scheme provides financial assistance for setting up new ventures or expanding existing ones.

This scheme facilitates the generation of employment opportunities by offering a mix of subsidy and bank credit to eligible entrepreneurs. By focusing on sectors like manufacturing, and service, PMEGP empowers individuals to become self-reliant and contributes to the country’s economic growth.

Table of Contents

Highlights of Credit-Linked PMEGP Loan Scheme for Startups

PMEGP Loan Scheme Details

Like CGTMSE Loan Scheme, PMEGP is administrated by the Ministry of Micro, Small and Medium Enterprises, at the national level the scheme is running by the Khadi and Village Industries Commission (KVIC). At the state level, it operates through State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centres (DICs), and banks.

In this setup, KVIC channels government subsidies through designated banks, facilitating direct disbursal to beneficiaries’ bank accounts.

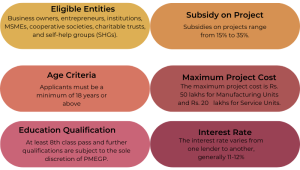

Initiated by the Government of India in collaboration with banks, PMEGP offers financial aid to establish new enterprises. Recent amendments to the scheme have raised the maximum project cost from Rs 10 lakh to Rs 20 lakh for service units and from Rs. 25 lakhs to Rs 50 lakhs for manufacturing units.

Under this program, business owners contribute only 5%-10% of the project cost, while the government provides a subsidy ranging from 15%-35% based on specific criteria. Financial assistance for enterprise owners from banks is offered in the form of term loans, working capital loans (cash credit, and composite loans).

For general category beneficiaries, banks approve 90% of the project cost, whereas for special category beneficiaries, it is 95%. The bank credit constitutes 60-75% of the total project cost, with the remaining 15-35% provided as margin money subsidy under the PMEGP scheme.

The loan options encompass term loans, working capital loans (cash credit), and composite loans that cover both working capital and capital expenditure. Manufacturing units have a capped working capital component at 40% of the project cost, while service/trading sector units are limited to 60% of the project cost.

PMEGP Scheme Objectives

The government started the PMEGP scheme with the following objectives:

- Create employment in rural and urban Indian areas through the establishment of self-employment micro-enterprises or projects.

- To enhance artisans income-earning capacity and foster growth in rural and urban employment.

- Establish a platform for traditional artisans and unemployed youth in both rural and urban areas to collaborate and create self-employment opportunities.

- Address the issue of rural-to-urban migration for employment by providing stable and sustainable job opportunities, particularly for traditional and prospective artisans and unemployed youth engaged in seasonal or traditional employment.

Also Read: Government Schemes for Scheduled Caste Community

Benefits of PMEGP

- Provide low-interest loans and subsidies for establishing new micro-enterprises in the non-farm sector in rural and urban areas.

- Encourage financial institutions to increase credit flow to the micro sector, reducing dependency on money lenders.

- Offer employment opportunities to traditional artisans and unemployed youth, reducing migration rates from rural to urban areas.

- Enhance employment and entrepreneurship characteristics of regions and the nation.

- Ensure equal and fair chances for subsidy qualification with less intensive eligibility criteria.

- Cover most industries, excluding those already included in the negative industries list.

Employment Sectors for Which PMEGP Loan is Sanctioned

The following employment sectors are eligible for PMEGP loan:

- Biotechnology and rural engineering

- Food processing cantered around agriculture

- Handmade paper and fiber

- Products derived from forests

- Textile industry

- Items based on minerals

- Products made from chemicals and polymers

PMEGP Scheme Subsidy

Beneficiaries benefiting from the PMEGP project need to contribute a small part of the project cost and, in return, get a subsidy on loans from banks associated with the scheme. This subsidy depends on the applicant’s category and where they live.

Subsidy under the scheme is called margin money, and if there’s any extra margin money, it goes back to the Khadi and Village Industries Commission.

Financial support levels under this scheme is as follows:

|

Category |

Beneficiary’s share in total project cost |

Share offered by the bank (Percentage of total project cost) | Subsidy rate in Urban areas |

Subsidy rate in Rural areas |

|

General |

10% |

90% |

15% |

25% |

| Special (including SC,ST,OBC, Minorities, Women, Ex-Servicemen, Transgenders, Differently-abled, NER, Aspirational Districts, Hill and Border areas(as notified by the Government) etc. |

5% |

95% |

25% |

35% |

Interest Rates in PMEGP Scheme

The interest rate provided by different banks in the PMEGP scheme vary based on factors like the applicant’s profile, creditworthiness, financial stability, repayment ability, business experience, invested cost, and total project cost.

For example, the interest rates for the scheme offered by the SBI is 10.80% w.e.f. 06-2022, and in HDFC bank the interest rates for PMEGP is 11-12%.

Eligible financial institutions for PMEGP loans include SBI, Bank of Baroda, Canara Bank, Bank of India, and several other private and public sector banks.

Repayment Duration

The repayment period, determined by the bank, typically spans from 3 to 7 years after an initial moratorium. This timeline allows borrowers to delay the commencement of repayments for a specified period, as per the bank’s terms.

Who Can Apply for PMEGP

- Any Indian citizen can apply

- Age of the applicant should be 18 years.

- Beneficiaries must have at least an 8th standard pass educational qualification.

- Assistance is available for new projects.

- For setting up projects under PMEGP no income ceiling is required

- Mandatory Entrepreneur Development Programme (EDP) training is required for eligibility for loan sanction and release.

- Eligible entities include self-help groups (even those below the poverty line, provided they haven’t benefited from another scheme).

- institutions that are registered under the Societies Registration Act, 1860.

- Production co-operative societies, and charitable trusts.

Units already benefiting under a state or central government scheme cannot apply for PMEGP loan.

Documents Required for Loan under PMEGP

- Application form, duly filled with passport-sized photographs.

- Project report.

- Identity proof of the applicant

- Address proof of the applicant.

- PAN card, Aadhaar card of the applicant

- 8th class pass certificate of the applicant

- If required, special category certificate of the applicant.

- Entrepreneur Development Program (EDP) training certificate

- Certificate for SC/ST/OBC/Minority/Ex-Servicemen/PHC.

- Academic and technical courses certificates if any.

- Any other document required by the Bank or NBFC.

How One Can Get a Loan Under PMEGY Scheme

The KVIC State/Divisional Directors, in collaboration with KVIB and the respective state Directors of Industries (for DICs), will put out ads in local newspapers and on TV to ask for applications and project ideas from people who want to set up businesses or service units under PMEGP.

Applicants can also apply online at kviconline. After applying online, they should print out the application and hand it in, along with a Detailed Project Report and all the needed documents, to the relevant offices.

To get a loan under the PMEGP scheme online, one can follow these simple steps:

- Go to the PMEGP official website of the Khadi and Village Industries Commission website. Read the instructions on the website to fill out the online application form according to your details. Make sure to provide all the necessary information based on your details.

- Once you’ve filled in all the required information, click on ‘Save Applicant Data’ to save the details you entered.

- After saving your data, it’s time to upload all the necessary documents to complete the application process.

- Once you’ve submitted the application, your ID number and password will be sent to your registered mobile number for future reference.

How One Can Check Loan Application Status using PMEGP e-Tracking System

- Go to the PMEGP official website where you submit your loan application

- Click on ‘Login, a new window will open (For registered Applicants) with Login and Password fields.

- Enter your ID and Password, then click on Login.

- After login click on View Status to check your application status.

Frequently Asked Questions (FAQs)

What is the PMEGP loan scheme?

The Prime Minister’s Employment Generation Programme (PMEGP) supports generation of employment in the country by providing necessary financial assistance

What is the maximum PMEGP loan limit?

Banks can provide a composite loan for a project, covering both Capital Expenditure and Working Capital. PMEGP sets the maximum project cost at Rs. 50 lakhs, including Term Loan for Capital Expenditure and Working Capital.

What is the income limit for PMEGP loan?

There is no income limit for assistance in starting a projects under PMEGP for an applicant.

What leads to PMEGP loan rejection?

In addition to the project report, absence of the Cybill report, factual errors in the application, lack of documents, and business knowledge are key reasons for loan application rejection.

How long does PMEGP application processing take?

Agencies will complete application scrutiny within 15 days and forward it to Banks if everything is in order. If the application is not in order, they may return it with reasons within 15 days.

How long is PMEGP training?

For projects costing up to Rs. 5 lakhs, training lasts at least 5 days, while for projects above Rs. 5 lakhs, Entrepreneurship Development Program (EDP) lasts at least 10 days. Projects up to Rs. 2 lakhs are not mandatory for EDP training.