Empowering women is crucial for the progress of any society. The government has introduced various welfare schemes for women in India to support and uplift women. This blog post, Empowering Women: Government Welfare Schemes in India, explores these initiatives in detail.

Women welfare initiatives in India focus financial independence, safety and more. These programs aim to provide women with the resources and opportunities they need to thrive.

By understanding and utilizing these schemes, women can achieve greater empowerment and contribute more effectively to society. This blog article will guide you through the key welfare schemes and their benefits for women in India.

Table of Contents

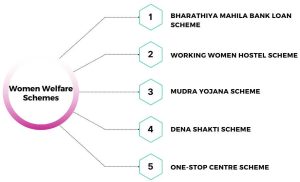

Welfare Schemes for Women in India

The government of India has initiated several schemes for women’s empowerment. Women empowerment schemes started by the government help women open new avenues and improve their lives in urban and rural areas.

Bharathiya Mahila Bank Loan Scheme

Bharathiya Mahila Bank Business is one of the welfare schemes for women in India. The scheme is tailored for those women entrepreneurs who wish to have a business with limited resources.

This system aims to provide financial assistance to women in need. Women who want to opt for this program can avail of a loan of up to 200 million (20 Crores). The repayment period is seven years.

Women can take this loan for four types of businesses- BMB Shringaar Loan (to launch or run a salon or beauty parlor). BMB Annapurna Loan (launching or running a food catering business). BMB Parvarish (launching a daycare center for children anywhere in India). And BMB SME Easy (women in small and medium-scale enterprises).

This loan scheme is most suitable for establishing a manufacturing company. One of the advantages of this loan is that no collateral is required for up to 1 crore for Micro and small businesses.

The terms of this scheme have not changed since its introduction in 2017, although Bharatiya Mahila Bank has merged with the State Bank of India (SBI). The lending bank will tell you the interest rate of this scheme.

Working Women Hostel Scheme

With the gradual change in the social and economic structure of the country, more and more women are leaving their homes and looking for work in large cities and urban and rural industrial sectors. One of the biggest problems for such women is the lack of safe and comfortable living.

Concerned about the difficulties these working women face, the Indian government introduced a working women hostel scheme.

The scheme aims to support the construction of new buildings/expansion of old buildings to provide housing for working women in cities, towns, and rural areas where women have job opportunities.

The program aims to provide safe and comfortable housing for working women and daycare facilities for their children, especially in urban, suburban, or even rural areas where women have job opportunities.

The scheme is meant for women who may be divorced, widowed, unmarried, or married, but their spouses or close relatives do not live in the same city. Women from weaker sections may be given priority under this scheme.

Working women hostel scheme accommodates women under training for jobs, provided that the total duration of the training is not more than one year.

Working women having an income of Rs. Fifty thousand (50000) in metropolitan cities and Rs. Thirty-five thousand (35,000) in other places are entitled to a hostel facility. For details, refer to wcd. nic.in

Also Read: Ujjwala Yojana Free Gas Cylinder

Mudra Yojana Scheme

Mudra Yojana Scheme is among the welfare schemes for women in India. The sole purpose of the Mudra loans is to promote the business culture of India and is given under the Pradhan Mantri Mudra Yojana (PMMY).

The scheme is not only for women but is a helping hand for women who want to start a business in India.

Anyone can avail of PMMY (Pradhan Mantri Mudra Yojana) loans to set up, expand, support, or modernize their Small and Medium Enterprises. 70% of loans have been sanctioned to women since the Mudra Yojana Scheme launch.

Mahila loan yojana is a specially designed system for women who are just starting, where women from all walks of life can obtain these loans. However, to be eligible, they must meet specific eligibility requirements.

- Entrepreneurs who run manufacturing companies are entitled to PMMY loans. Examples are craftsmen, artisans, weavers, and so on.

- Entrepreneurs can use these loans to establish, expand or modernize a company providing services such as tailoring, mobile repair, photocopying, auto-repairing, beauty parlor, service centers, and more.

No securities are required to qualify for this mudra yojana loan. Individual loans of up to Rs 50,000 are provided, but a group of women in collaboration can apply for this program.

The credit limit for this loan scheme is Rs 50,000 to 10,00,000. A woman must provide security if she wants more than Rs 10 lakh.

Three types of loans are sanctioned under Mudra Yojana Loan, which are:

- Shishu: Loan amount up to Rs. 50,000/

- Kishor: Amount above Rs. 50,000 up to 5,00000/

- Tarun: Loan above 5 lakhs up to 10 lakhs

Dena Shakti Scheme

The Dena Shakti scheme’s primary goal is to provide affordable funding for women entrepreneurs involved in various activities such as agriculture, manufacturing, micro-credit, retail stores, education, housing, etc.

Establishing the Dena Bank, a public sector bank aims to increase women’s economic opportunities and pave the way for their economic liberation. The bank is establishing a credit network for women entrepreneurs.

The Dena Shakti scheme is a loan scheme that can meet working capital needs or develop a business.

Women who want to engage in activities like agriculture, manufacturing, retail stores, etc., can benefit from this scheme and avail of this loan from Rs. 50,000 up to 20 lakhs.

Under the Dena Shakti Bank scheme, a woman can get a loan for:

- Agriculture activities – loan amount up to 20 lakhs

- Manufacturing, retail trader, or small enterprises – loan amount up to 20 lakhs

- Retail Trader and micro-credit – loan amount up to 50,000 for micro-credit schemes

- Repayment period: 7 years

- Processing fee: 0.5% of the loan amount

One-Stop Centre

One-Stop Centre (OSC) is one of the Welfare Schemes for Women in India under the Department of Women and Children Development. The scheme aims to support women victims of violence in the private and public sectors, family, community, and workplace.

Women who are physically, sexually, mentally, spiritually, and financially abused, regardless of age, class, class, education, marital status, race, or culture, are given support and recovery.

Specialized services are provided to women in these one-stop centers who have been victims of sexual harassment, domestic violence, human trafficking, honor crimes, acid attacks, or witch-hunting.

The goals of the system are:

- The one-stop centers support and assist women victims of violence in the private and public sectors under one roof.

- Provide immediate access to several essential services. These services include medical, legal aid, psychological support, and counseling to fight against violence against women.

Services provided by OSC

- Rescue services

- Medical assistance

- Psychological – social support/counseling

- Legal aid and advice

- Shelter, etc.

For full details about the scheme, visit wcd.nic.in

Impact of Women Empowerment Schemes in India

The impact of welfare schemes for women in India has been transformative, enhancing their social and economic status. These programs have opened new opportunities and supported women in various sectors.

The Mudra Yojana Scheme provides financial assistance to women entrepreneurs, enabling them to start or expand their businesses. This scheme has empowered many women to achieve financial independence.

Similarly, the Bharatiya Mahila Bank Loan Scheme offers loans to women at competitive interest rates, encouraging them to venture into different fields. The Dena Shakti Scheme focuses on providing credit to women in agriculture, retail, and small businesses, fostering growth and self-reliance.

These welfare schemes for women in India have significantly contributed to their empowerment, allowing them to actively participate in the economy and improve their livelihoods.

Conclusion

The schemes we discuss here are helping women to empower them. Initiatives aimed at women make them independent and take positions or make decisions. Women empowerment schemes aim to eliminate gender-based discrimination against women in business, education, etc.

The above-mentioned women’s empowerment programs are initiatives by the government to eliminate gender bias in all possible ways so that women can start entrepreneurship.

In addition to women’s initiatives, the Indian constitution also provides protection for women’s education, rights, and equality in all areas.