The JK Bank online money transfer facility facilitates its customers to transfer money without going to the bank in person. You can use online money transfer facilities such as NEFT, RTGS, or IMPS to transfer money to anyone’s account nationwide.

You can also use J&K Bank’s mPay application to transfer money within the accounts of J&K Bank and outside the bank.

JK online banking is a convenient way for retail customers and corporate customers to do banking because they can access their accounts anytime (24×7) from anywhere with the World Wide Web (WWW).

The customers do not have to stand in queues and also avoid delays and can try new simple and secure online banking features.

Here in this post, we will see how you can transfer money through the JK bank online money transfer facility.

Table of Contents

How to Transfer Money Online Money From J&K Bank

JK Bank offers convenient online money transfer services through various modes, simplifying financial transactions for its customers.

Whether utilizing internet banking, mobile banking apps, or USSD codes, JK Bank Online Money Transfer ensures secure and efficient fund transfers within and outside the bank.

With these accessible options, customers can manage their finances conveniently from the comfort of their homes or on the go.

mPay Money Transfer

J&K Bank mPay application makes banking much easier. J&K Bank mPay is a mobile application that you can use to access your bank account using your smartphone. Using the mPay app you can view account details, transfer money, recharge mobile/DTH, pay for electricity/water, and a lot more.

J&K Bank existing customers with a savings/current account and a mobile phone registered with the bank can use the mPay app.

Now you no longer have to visit the branch for services such as Balance Enquiry, Mini Statement, and Money Transfer within J&K Bank, NEFT/RTGS payments, term deposits, Credit Card Enquiry, etc.

How to Activate J&K Bank mPay

You can download J&K Bank’s mPay mobile banking application from the Google Play Store for Android mobiles and from the App Store for iOS. After you install the app you need to enter your card details for registration.

You can follow the below steps for registration.

- Open the mPay app from your smartphone after installation.

- Enter your debit (ATM) card number.

- Enter debit card PIN

- Provide your card expiry date

- Now press OK

- The bank will validate your information and send you an OTP.

- Enter the OTP you received.

- Once OTP validation is completed, you will successfully register for J&K Bank mPay, and the bank will send you a default MPIN through SMS on your registered mobile. You can change the MPIN later.

- The mPay application has no user name; it works on two pins i.e. Login password and MPIN both of which are 4 digits.

Also Read: SBI Sovereign Gold Bond Scheme

Fund Transfer Services Available on mPay

Fund transfer services available on mPay are:

Transfer within JK Bank

- Mobile-to-Account

- Mobile-to Mobile

Transfer to another Bank

- NEFT

- RTGS

- IMPS

mPay Transfer Limit

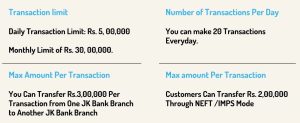

- 5, 00, 000 is the daily transaction limit, and Rs. 30, 00, 000 is the monthly transaction limit.

- The total per day transaction number is 20

- Within the J&K bank, the maximum amount per transaction is Rs. 3, 00,000.

- For NEFT/RTGS the maximum amount per transaction is Rs. 2, 00, 000.

How to Transfer Money From JK Bank mPay Delight Plus?

You can transfer money within JK Bank or outside JK Bank using mPay.

- To transfer funds within JK Bank you can send it by Mobile-to-Account or Mobile-to-Mobile option. For the Mobile-to-Account option, you have to enter the beneficiary account number, and for the Mobile-to-Mobile option, you have to enter the mobile number of the beneficiary which is registered with the bank.

- To transfer money outside the JK Bank from the mPay app you can send it through NEFT RTGS or IMPS options. For these options, you must first add the beneficiary and his/her details like his account number, IFSC Code, Nickname, etc.

Online Money Transfers through the Internet Banking

Another way to transfer money through JK Bank is an Internet banking facility. If you are registered for this facility go to jkbankonline, and enter your User ID and password, after successful login, search for money transfer.

Enter the beneficiary details such as Account Number, IFSC Code, amount, and other necessary details and transfer the money via. NEFT/IMPS.

If you are not registered for the netbanking facility then follow the steps below for registration.

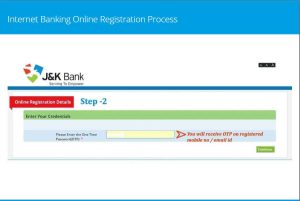

Go to jkbankonline a user ID box will appear on the Bose’s bottom see for “click here to create one”.Click on that message.

Enter your account number, date of birth/PAN card number

After entering your account number, DOB, and PAN Number you will receive OTP on your mobile number registered with the bank, enter that OPT.

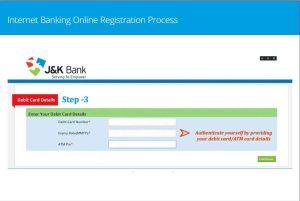

After entering OTP a new dialog box will appear where you will be asked to provide your Debit/ATM card details such as card number, expiry date, and ATM PIN, ether your card details, and go ahead.

Now set your Login and Transaction password. Passwords should be strong and a mix of words, digits, and special characters.

After completion of all the above steps, a User ID and password will be generated online for you that you can use to log into your net banking account.

NEFT Money Transfer

National Electronic Funds Transfer NEFT) is one of India’s most important electronic capital transfer systems. Introduced in November 2005, NEFT is a facility for bank customers to quickly and securely transfer money from one account to another.

NEFT is a nationwide payment system that allows secure transactions throughout the country.

Before transferring money to any beneficiary you have to first add that beneficiary from the mPay app or through your net banking account, and add his details like his account number, Nickname, IFSC Code of the bank where his accounts are located, etc.

RTGS Money Transfer

RTGS means Real-Time Gross Settlement. Based on the gross settlement concept, RTGS is a money transfer system where money is transferred from one bank to another in real time. RTGS is primarily intended for large-value transactions.

So even if there is no upper limit on the amount transferred, you have to transfer at least Rs. 2 lakh at a time. The payment system is handy when the amount of transactions is large and payments need to be processed quickly.

As with NEFT, the information required for a normal RTGS transfer is the payee name, account number, account type, bank name, and IFSC code.

IMPS Money Transfer

IMPS (Immediate Payment Service) is a service provided by banks to ensure the transfer of funds between banks in real time. Unlike NEFT, money can be sent through IMPS every day of the week, including public holidays and weekends.

IMPS allows customers to use their mobile phones as a channel for interbank transfers. It includes the transfer of funds to another bank account via P2A (Phone-to-Account), and P2P (Phone-to-Phone).

P2A (Phone-to-Account)

P2A allows customers to send money to other bank accounts using the beneficiary account number and the IFSC branch code where the beneficiary account is located.

Phone-to-Phone (P2P)

P2P allows customers to send/receive funds using their phone number and MMID (Mobile Money Identifier).

- Mobile Money Identifier (MMID) is a 7-digit number assigned to the customer’s account that allows him/her to receive money. The customer only needs MMID to receive money. To send funds to a recipient, the MMID and phone number of the recipient are needed.

- To create an MMID, go to IMPS: Create MMID, MMID for each registered account number will be sent through SMS.

Frequently Asked Questions (FAQs)

1. How can I initiate an online money transfer with JK Bank?

To initiate an online money, transfer with JK Bank, you can use their internet banking portal, mobile banking app, or USSD codes provided by the bank.

2. Are there any transaction limits for JK Bank online money transfers?

Yes, JK Bank may have transaction limits for online money transfers. These limits can vary depending on factors such as the type of account and the specific transfer method used.

3. What are the different modes available for online money transfer through JK Bank?

JK Bank offers various modes for online money transfer, including internet banking, mobile banking apps, and USSD codes. Customers can choose the most convenient option based on their preferences and accessibility.

4. How long does it take for a JK Bank online money transfer to be processed?

The processing time for a JK Bank online money transfer can vary depending on factors such as the destination bank, the transfer method, and any intermediary banks involved. Typically, transfers within the same bank may be processed faster than transfers to external accounts

5. Is it safe to transfer money online using JK Bank’s platforms?

Yes, JK Bank ensures the safety and security of online money transfers through encryption protocols and robust authentication measures. Customers can trust that their financial information is protected when using JK Bank’s online platforms for money transfers.

6. Are there any fees associated with JK Bank online money transfers?

JK Bank may charge fees for certain online money transfer services, such as outward remittances or international transfers. The fees can vary depending on the transfer amount, destination, and the specific service utilized. It’s advisable to check with the bank for details on applicable fees before initiating a transfer